It’s no surprise we’re going through a bit of rough time right now. We have no idea where we’ll be on the other side. It sucks. To say that I’m nervous would be an understatement. But, I still remain optimistic.

A decade ago now, I used to tune into NASA TV on YouTube. It aired 24/7 broadcasts of practically everything space and science. Basically, what Discovery Channel used to be. Space Station Live was their news-equivalent show that kept an eye on the ISS. I managed to catch that a lot of that.

Recently, I’ve gotten into watching a lot of flat earth debunking videos. It’s become a bit of guilty pleasure, to say the least. While it is fun poking fun at a Flerf’s attempts to constantly prove a negative, I have learned quite a lot from those doing the debunking. That’s what really got me thinking about space a lot more than I normally do.

With the simple of exception of NASA’s logos, everything of theirs is in the public domain because it is a government agency. That means I can syndicate their old videos and live recordings to recreate my own NASA TV. So, after I discovering a bunch of their stuff on Archive.org, I did just that.

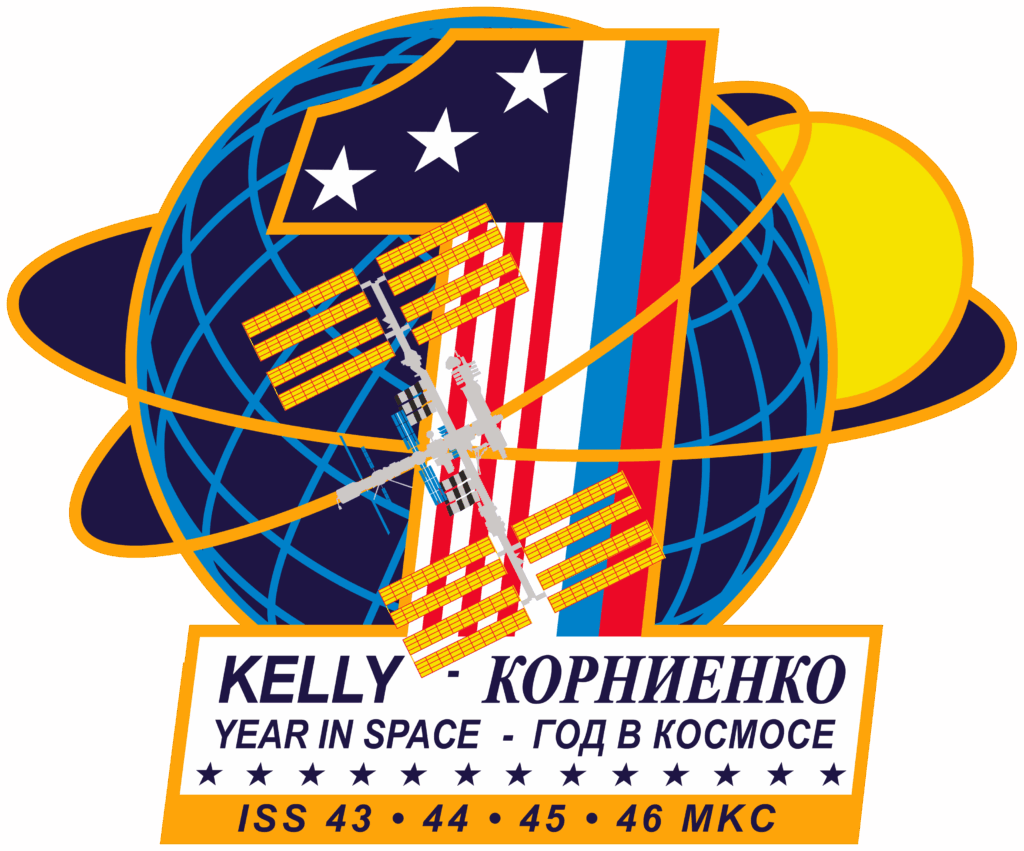

Inspired by G4 Rewind, NASA Rewind is a marathon block that syndicates videos about Artemis, ISS, and One-Year Mission when I’m not live streaming games or art. Additionally, there are Apollo, Mission Control, and Space Shuttle documentaries. Personally, it feels exactly like what I grew up with.

NASA TV itself doesn’t seem to be a thing anymore and seems to have been succeeded by their on-demand streaming service. The only thing left that’s live 24/7 is their view from the ISS. It’s only gotten worst ever since this administration scaled back their social media presence for “efficiency” reasons. People following SpaceX launches have pretty much picked up the slack since then.

So, what does NASA Rewind bring? Personally, I’ve had this idea of “what if my characters went to space?” No matter what other concept I’ve thrown at the wall, I always come back to that. This gives me inspiration. No AI needed. Fiction aside, I want to bring hope. Even if we’re all that’s out there, we still have the stars to keep us company, and science will always march on.